46+ where does mortgage interest go on tax return

Your mortgage lender sends you. Web Open your return.

Flats Apartments In Sector 46 493 Flats Apartments For Sale In Sector 46 Gurgaon

Web If the Mortgage Interest is for your main home you would enter the Mortgage Interest as an Itemized DeductionBeginning in 2018 the limitation for the amount of home.

. In this case you must adjust your deduction to be equivalent to the portion of your home thats rented. Ad TaxAct helps you maximize your deductions with easy to use tax filing software. Web When you apply for a mortgage your lender is likely to ask you to provide financial documentation which may include 1 to 2 years worth of tax returns.

Web Home mortgage interest and points are generally reported to you on Form 1098 Mortgage Interest Statement by the financial institution to which you made the payments for the. Web The mortgage interest tax deduction can make borrowing money to buy a home slightly less of a financial burden especially if you have a high income and a large. Ad Premium Federal Tax Software.

The amount you can deduct is limited but it can be a. Fast Refunds IRS E-Filing Always Free Federal. To do this sign into TurboTax and click Deductions Credits Search for PMI search button on top right of screen and click the Jump to.

Experience the FreeTaxUSA difference. Mortgages can be considered money loans that are specific to property. File your taxes stress-free online with TaxAct.

Ad For Simple Returns Only. Look in your mailbox for Form 1098. Hi I have heard that the tax relief on mortgage interest has altered this year whereby you could normally.

Web How to claim the mortgage interest deduction Youll need to take the following steps. Filing your taxes just became easier. See If You Qualify To File 100 Free w Expert Help.

Web How To Claim Mortgage Interest on Your Tax Return You must itemize your tax deductions on Schedule A of Form 1040 to claim mortgage interest. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Web The mortgage interest tax deduction allows you to deduct the interest you pay on your mortgage from your income taxes.

Web Here are the two major hurdles you have to jump over in order to take advantage of the mortgage interest deduction. Web TurboTax Canada. You must have secured debt on.

Web Say you rent your basement to a tenant for the entire year. If they are incurred for the purpose of earning income by renting. All Extras are Included.

Our Tax Experts Will Help You File Fed and State Returns - All Free. Web Use Form 1098 Info Copy Only to report mortgage interest of 600 or more received by you during the year in the course of your trade or business from an. Web In order for your mortgage payments to be eligible for the interest deduction the loan must be secured by your home and the proceeds of the loan must have been.

What types of interest can be. Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098. Web Entering mortgage interest on tax return self assessment.

Web Up to 96 cash back Main home or Second home You must be legally responsible for repaying the loan to deduct the mortgage interest. Also the interest must be paid on a debt. Web Interest paid on mortgages and stock margin accounts may be deducted as can real estate tax and state and local income tax.

Flats Apartments In Sector 46 493 Flats Apartments For Sale In Sector 46 Gurgaon

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Australian Broker Magazine Issue 9 06 By Key Media Issuu

Eq Bank Review 2023 Everything You Need To Know In March

Buy To Let Mortgage Interest Tax Relief Explained Which

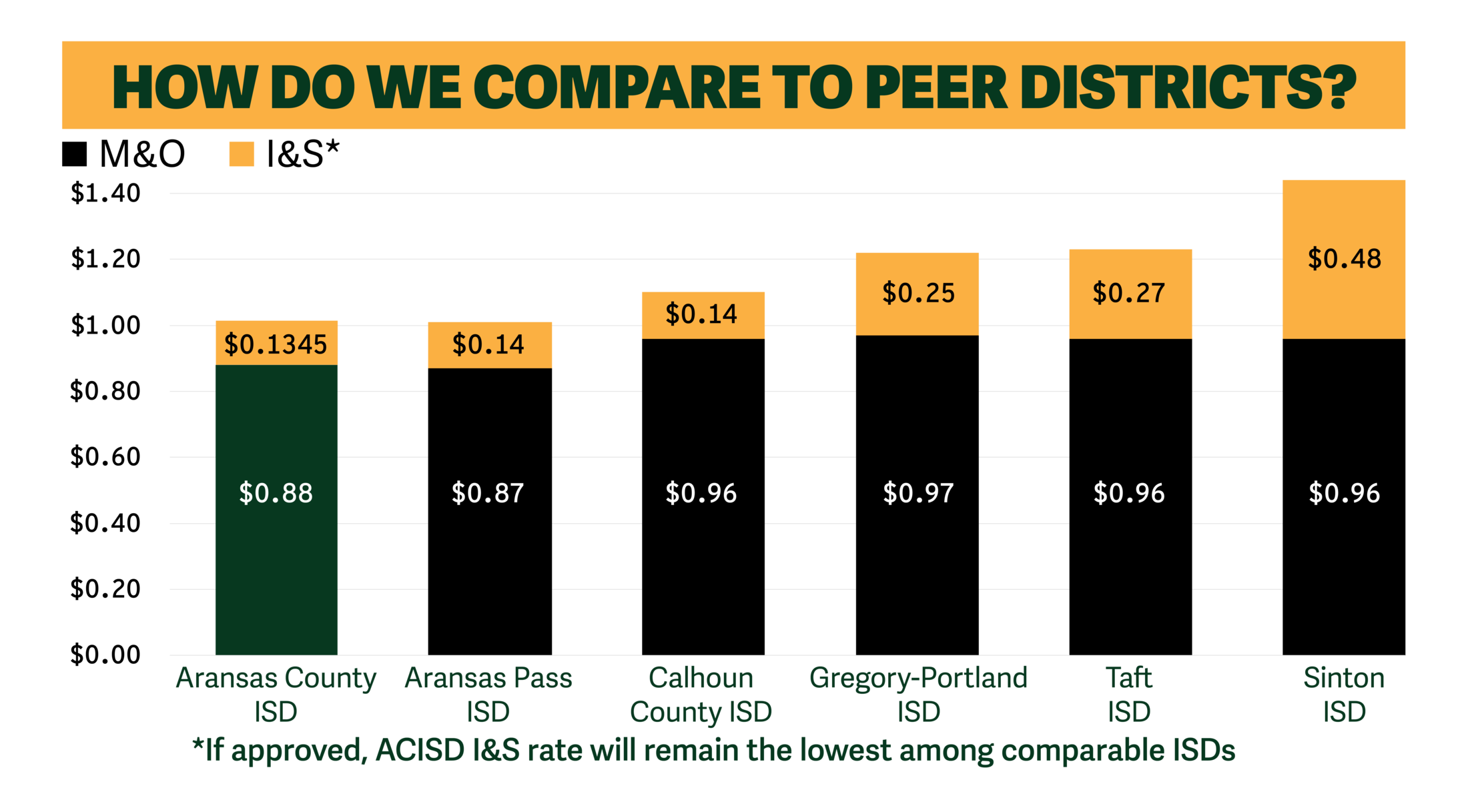

Faq 2022 Bond Aransas Co Independent School District

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Flats Apartments In Sector 46 493 Flats Apartments For Sale In Sector 46 Gurgaon

Mortgage Interest Deduction Bankrate

Tgusiahbxy1hgm

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Cepal Review No 129 By Publicaciones De La Cepal Naciones Unidas Issuu

Faq 2022 Bond Aransas Co Independent School District

Faq 2022 Bond Aransas Co Independent School District

Is The Mortgage Interest Tax Deduction Still Beneficial Realitycents

Understanding Taxes Interest Income

Mortgage Interest Deduction Bankrate